Turkish Central Bank forecasts 36 pct inflation rate for 2024

Turkish Central Bank announced the year-end inflation forecast as 36 percent for 2024 and 14 percent for 2025. The bank predicted that inflation would decline to 9 percent at the end of 2026.

Duvar English

Turkey’s Central Bank announced the year-end inflation forecast for 2024 as 36 percent and 14 percent for 2025, similar with the previous report.

Fatih Karahan, the newly appointed Governor of the Central Bank, shared the First Inflation Report of the year at an information meeting.

Karahan underlined that the tight monetary policy stance would be maintained until a significant improvement was achieved in the inflation outlook.

The lower and upper points of the forecast ranges correspond to 30 and 42 percent for 2024 and seven and 21 percent for 2025. Inflation was projected to decline to single-digit levels in 2026, end the year with nine percent, and stabilize at the five percent target in the medium term.

“Due to wage and administered price adjustments as well as the backward-indexation behavior, monthly services inflation rose significantly, and was slightly above our forecast. This development was also influenced by the minimum wage increase, which exceeded our projections,” Karahan stated in his speech.

Consumer inflation ended 2023 at 64.8 percent. The government-run Turkish Statistical Institute (TÜİK) reported Turkey’s annual inflation rate as 64.86 in January.

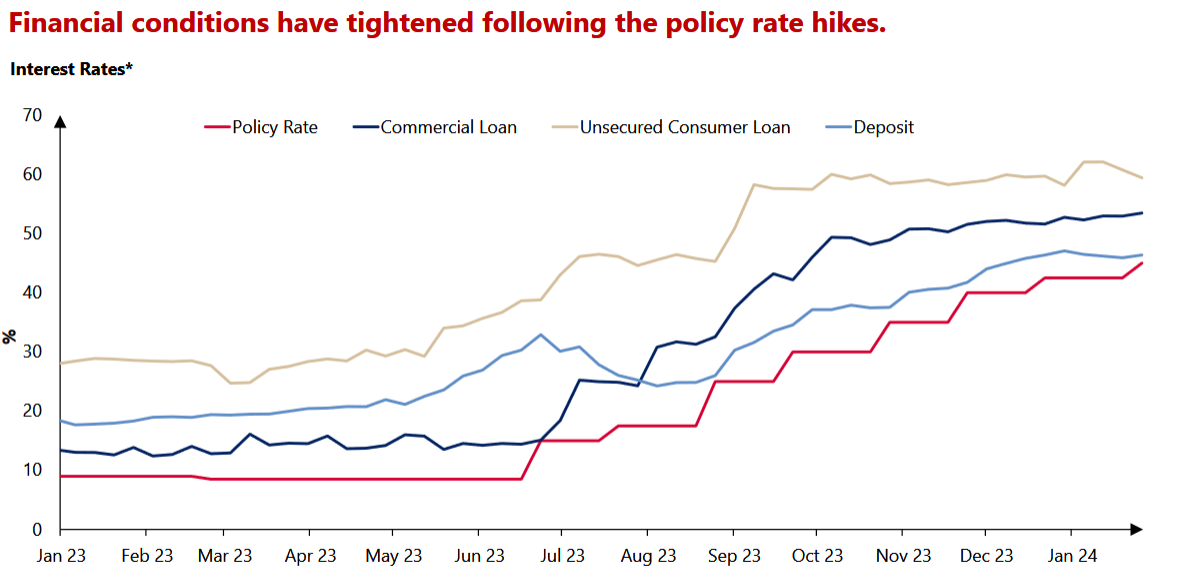

The bank has increased policy rate from 8.5 percent to 45 percent in line with the monetary tightening process after the 2023 General Elections and announced that the increases would be halted in the near future.

Karahan also underlined that the current level of the policy rate “would be maintained as long as needed” until there would be a “significant decline in the monthly underlying trend of inflation” and “convergence of inflation expectations to the projected forecast range.”

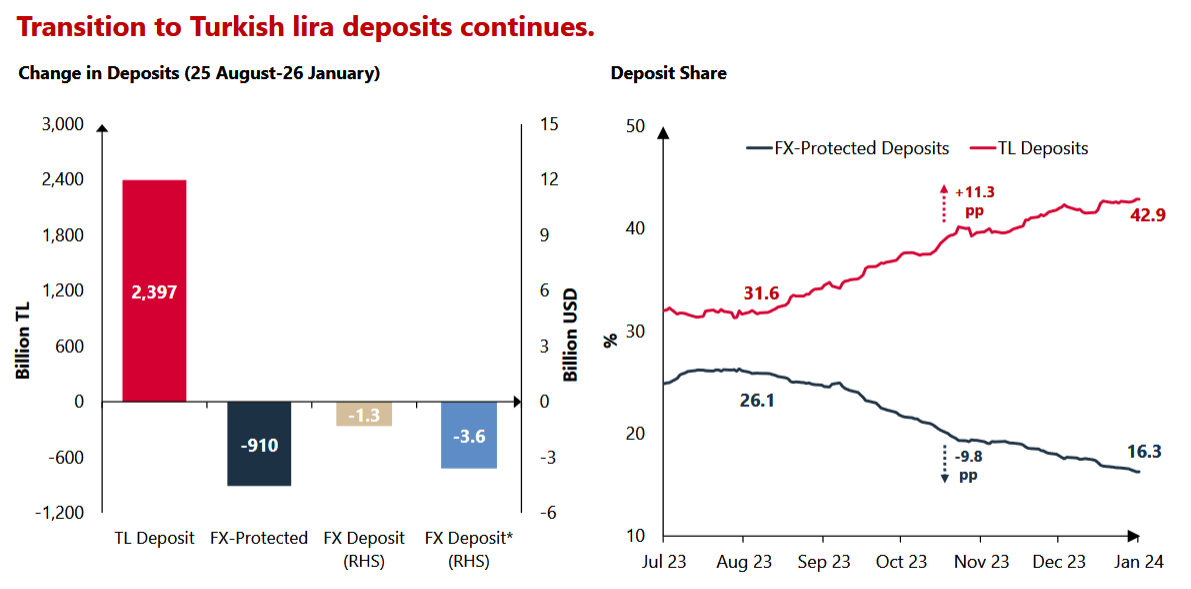

The governor also shared that new economic administration's decision to scale back from FX-protected deposit scheme and prioritize Turkish lira deposits was successful as the former's share declined to 16.3 percent as of Jan. 24.

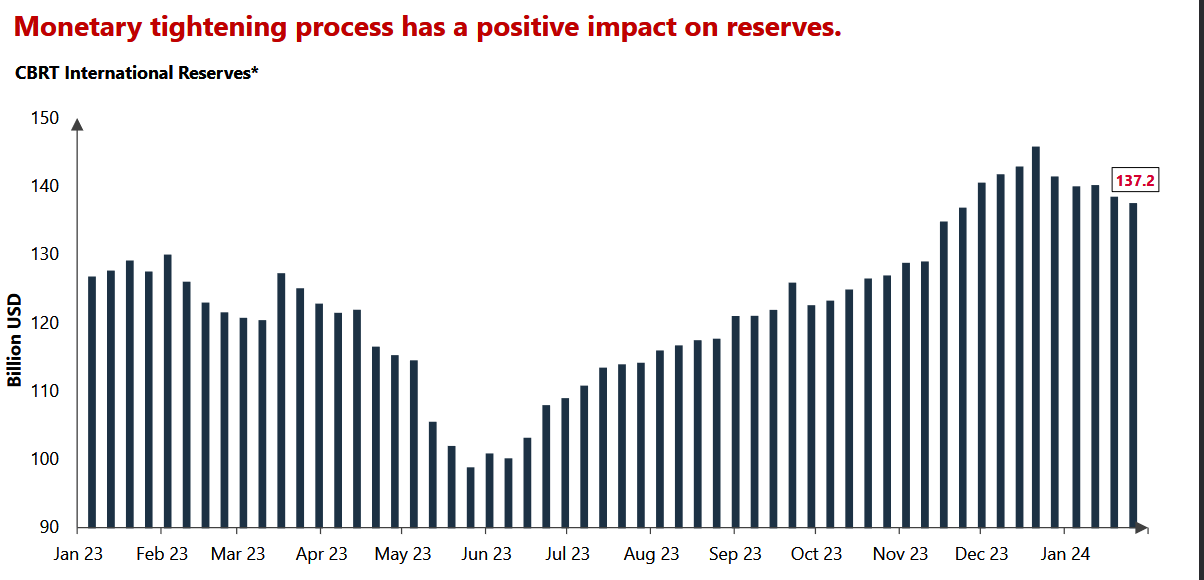

Karahan also announced that monetary tightening process had an positive impact on Central Bank's reserves as they reached 137.2 billion dollars as of Jan. 24.

Karahan did not answer any of the questions regarding former governor Hafize Gaye Erkan coming from the journalists.

When asked whether they take into account the expected hike in electricity and natural gas after the local elections on March 31, he said, "Of course, when we make our inflation forecasts, we make a projection for the increases that may be made in many items and the increases in these managed products. An adjustment is expected in electricity and natural gas."

New Turkish Central Bank Governor says determined to maintain monetary tightness until inflation falls to targetEconomy

New Turkish Central Bank Governor says determined to maintain monetary tightness until inflation falls to targetEconomy Erdoğan appoints Central Bank Deputy Governor Karahan as new chief following Erkan's resignationEconomy

Erdoğan appoints Central Bank Deputy Governor Karahan as new chief following Erkan's resignationEconomy Turkish Central Bank raises interest rate to 45 percent, halting monetary tightening cycleEconomy

Turkish Central Bank raises interest rate to 45 percent, halting monetary tightening cycleEconomy