How low can you go? Five questions for Turkey's central bank

Turkey's central bank is expected to cut interest rates again this week despite a currency crash and soaring inflation. Here are five questions ahead of the central bank's policy-setting meeting scheduled for 2 p.m. (1100 GMT) on Dec. 16.

Reuters

Turkey's central bank is expected to cut interest rates again this week despite a currency crash and soaring inflation as President Recep Tayyip Erdoğan keeps up the pressure on policymakers to promote growth ahead of elections in 2023.

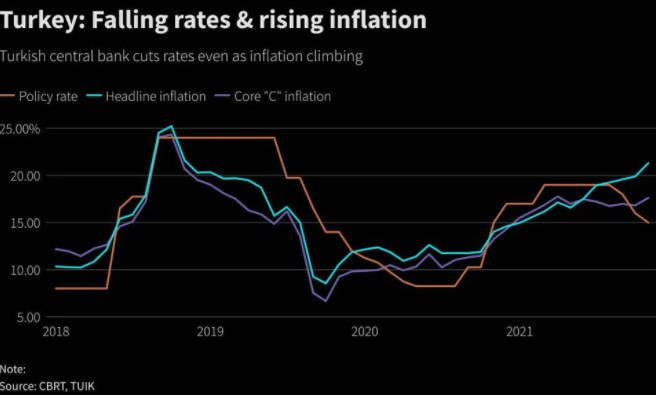

The bank has slashed its key rate (TRINT=ECI) by 400 basis points to 15% since September as part of Erdoğan's plan to prioritize exports and lending, even though economists and opposition lawmakers say the moves are reckless.

The central bank has also sold dollars four times this month to slow a volatile sell-off that has left the Turkish lira closing in on 15 to the greenback - a record low and half its value at the beginning of 2021.

Here are five questions ahead of the central bank's policy-setting meeting scheduled for 2 p.m. (1100 GMT) on Dec. 16:

Can rate cuts continue?

The bank has signaled it will cut rates once more this month before pausing in January. Erdoğan has not specified how low he wants rates to go but has repeated that cuts are needed.

Analysts polled by Reuters expect a 100 basis-point cut this week. Only one respondent predicted rates would remain on hold, given that more easing could exacerbate the lira's depreciation and soaring inflation, which was running at 21.3% last month.

On a conference call with foreign investors this month, a central bank policymaker said in response to a question that there was a higher probability of rates staying at 15% in December given the market turmoil, according to one participant.

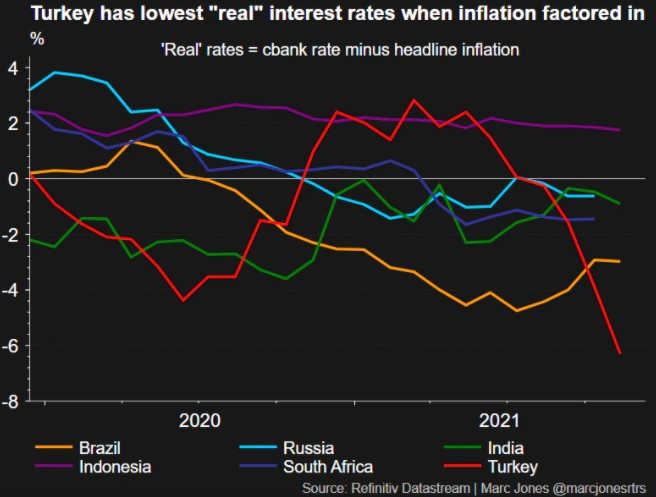

But most analysts believe Turkey's easing cycle will continue, even though most central banks globally are tightening policy, leaving the country with deeply negative real rates.

To pave the way, Erdoğan replaced the leadership at the central bank and finance ministry with like-minded officials this year. All have embraced his low-rates mantra.

"The placement of pawns in important positions indicates that the country's fight for low interest will continue despite the market's heavy rejection. But the market always wins this chess game," said İpek Özkardeşkaya, an analyst at Swissquote.

What are the risks?

Turkey's chronic trade imbalance means the lira's weakness translates into higher inflation via imports.

Reflecting the currency's depreciation, Turkey's producer price index soared nearly 55% in November from a year earlier, prompting economists to predict that headline consumer prices would hit 30% next year - five times the official target.

Another risk is that businesses shy away from the lira given the unpredictability of both exchange and inflation rates.

"There is no commerce now, there is no cash," said Kemal Çakır, 32, a sales representative at Çakıroğulları Agricultural Machinery in the Central Anatolian province of Konya. "We expect to see bigger losses in the future."

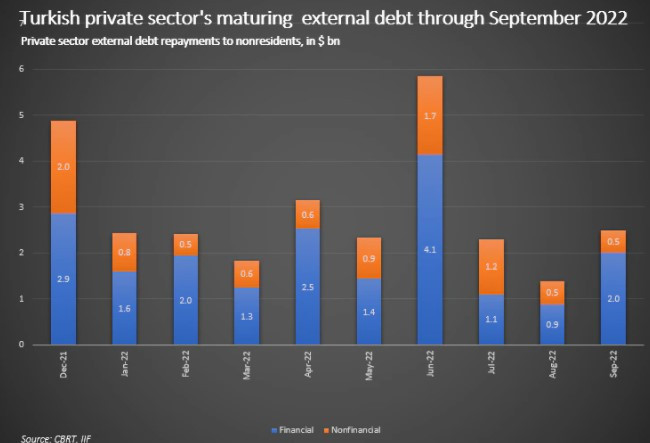

A more remote possibility is that companies struggle to meet foreign debt obligations, given the country's overall 12-month refinancing needs of nearly $170 billion.

There was, however, a current account surplus of $3.1 billion in October, helping to ease such concerns. Erdoğan has said that remaining in the black is vital to easing inflation and becoming more self-sufficient.

Are Erdoğan's supporters losing faith?

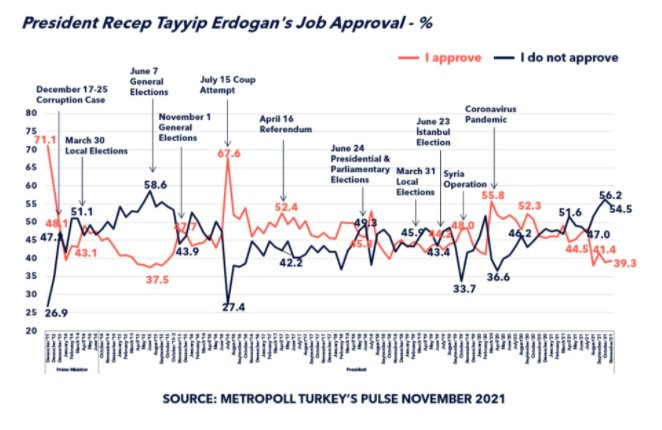

Opinion polls show both Erdoğan and his Islamist-rooted Justice and Development Party (AKP) are sliding to levels of unpopularity not seen in years and that he would probably lose a presidential election run-off against some potential rivals.

The rate cuts are a risky wager by Turkey's leader of 19 years that he can bring down high unemployment by squeezing businesses to invest and hire, even though rising prices and the lira's collapse are eating into Turks' earnings.

Some AKP voters told Reuters they could support other parties at the next election.

Others are keeping the faith in a president who has a solid base among the rural and urban working and middle classes. A Metropoll survey shows his approval rating has held near 40% over the last few months.

"Business is terrible and we have been deeply affected as well. Still, I believe Erdoğan will definitely be able to fix this situation," said a 50-year-old restaurant owner in the Black Sea province of Samsun who declined to be named.

How long can the central bank support the lira?

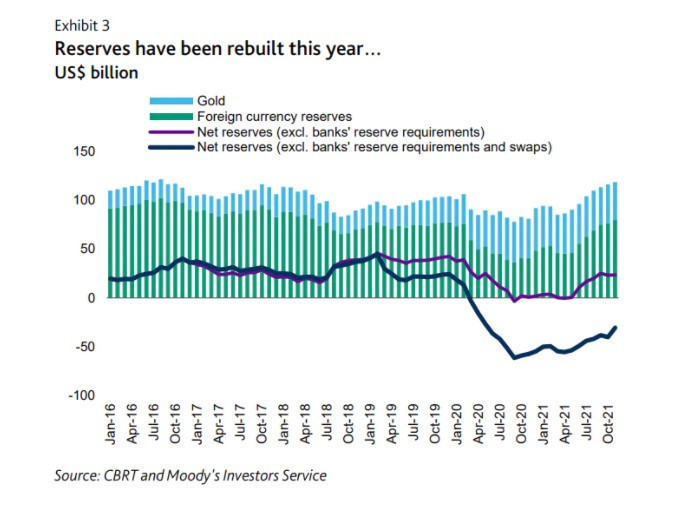

The central bank's ability to continue intervening to address what it calls "unhealthy" foreign exchange (FX) rates depends on several factors: how far it taps already depleted FX reserves, how much lower it cuts rates, policy decisions by the U.S. Federal Reserve and other central banks, and whether Turks add to their near-record hard currency holdings of $231 billion.

Technically, the bank could tap into $124 billion of gross reserves but net reserves are only worth $22 billion - and its holdings are deeply negative when swaps with state banks are taken into account. read more

On Dec. 13 alone, the bank spent $2 billion to $2.5 billion buying lira after it crashed briefly to a record 14.99, according to calculations by bankers. It sold $2.5 billion in the first three market interventions last week, they said.

Atilla Yeşilada, an analyst at GlobalSource Partners, estimated that the bank's interventions could last up to six months, as long as monetary policy is unchanged. But he and others say the sales waste precious reserves at a time of economic stress.

"Ultimately, the era of floating exchange rates is a confidence game to a large extent, and (the central bank) has lost it," said Marc Chandler, chief market strategist at Bannockburn Global Forex.

How has life changed for Turks?

The rapid slide in the lira has upended household budgets, scuttled travel plans and left many Turks scrambling to cut costs. Many now queue for subsidized bread in Istanbul, where the municipality says the cost of living is up 50% in a year, including a 71% jump in rents.

Soaring import prices have created shortages of medicines and briefly halted sales of cell phones and other electronics as retailers scrambled to recalculate prices last month. Builders say some projects are being delayed by high materials prices.

The government is moving to present an additional 2022 budget due to the need for more spending and a higher minimum wage, Reuters reported on Dec. 14.

Street protests have been only sporadic due largely to a years-long police crackdown on civil disobedience.

"The only push-back that the president is likely to face in the coming months is from social unrest, triggered by ever-rising inflation and disorderly markets triggered by continuing depreciation of the lira," said Lawrence Brainard at TS Lombard, a consultancy in London.

As prices skyrocket, people in Turkey forced to buy less food from marketsEconomy

As prices skyrocket, people in Turkey forced to buy less food from marketsEconomy Turkey's currency crash hammers the nation's buildersEconomy

Turkey's currency crash hammers the nation's buildersEconomy Turkish house sales to foreigners hit record level as lira slidesEconomy

Turkish house sales to foreigners hit record level as lira slidesEconomy Turkey's medical workers protest low wages, harsh conditionsDomestic

Turkey's medical workers protest low wages, harsh conditionsDomestic