Market participants set year-end dollar to Turkish lira expectation at 40

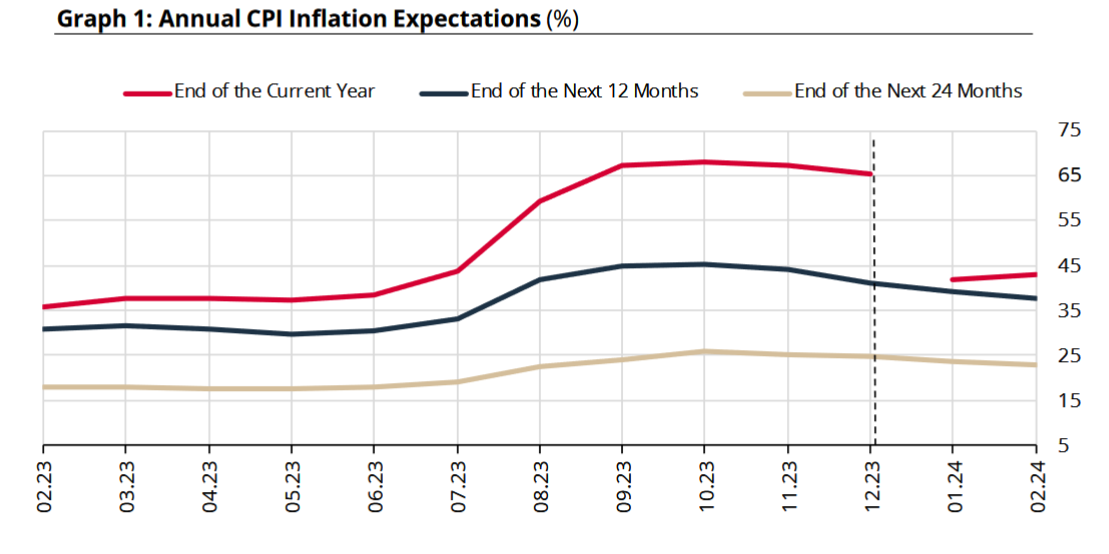

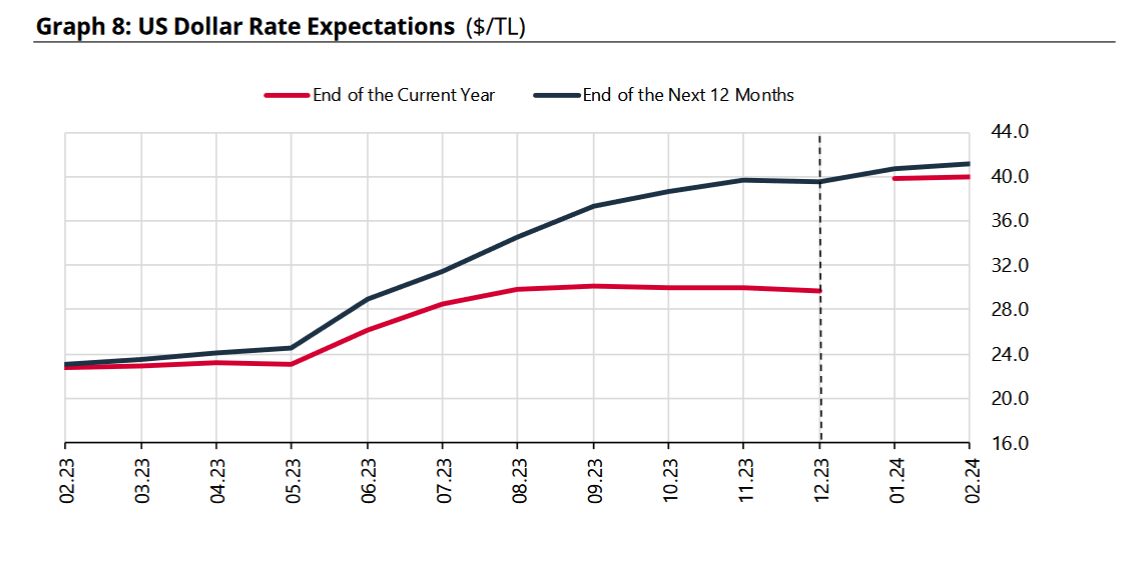

According to the Central Bank's Survey of Market Participants, the year-end forecast for the Consumer Price Index (CPI) inflation stood at 42.96 percent, with an expectation of 40 lira for the year-end dollar/Turkish lira exchange rate.

Duvar English

The Central Bank of Turkey published the February version for the Survey of Market Participants, which was conducted with 68 respondents consisting of real and financial sector representatives.

Accordingly, the Consumer Price Index (CPI) inflation expectation for February, which was 3.51 percent last month, increased to 3.80 percent in this survey period. The year-end CPI inflation expectation also increased from 42.04 percent to 42.96 percent for 2024.

Inflation was 64.86 percent according to the Turkish Statistical Institute (TÜİK) and 129.11 percent according to the independent Inflation Research Group (ENAG).

The year-end dollar/Turkish Lira expectation of the participants was 40.0212, while the 12-month dollar/lira expectation increased from 40.6370 to 41.1543.

Dollar/lira was traded at 30.84 as of Feb. 16.

The year-end current account deficit expectation, which was 34.4 billion dollar in the previous survey period, increased to 34.6 billion dollar in this survey period. The current account deficit expectation for next year decreased to 32.9 billion dollars.

Gross Domestic Product (GDP) growth expectation for 2024 decreased from 3.4 percent to 3.3 percent, and growth expectation for 2025 decreased from 3.9 percent to 3.8 percent.

Expectations for the Central Bank’s policy rate for the end of February and three months were expressed as 45 percent. The 12-month ahead policy rate expectation was stated as 36.62 percent.

After policy rate reached 45 percent, the Central Bank announced that it would halt further policy rate increases and sustain the current level for a certain period until deflation process consolidated.

All 11 respondents surveyed by Reuters also concurred that the policy rate would remain unchanged this month. The survey indicated an expectation of a policy rate of 37.5 percent by the year's end, with forecasts ranging from 35 percent to 45 percent among the 10 institutions responding. Only one institution predicts a year-end policy rate of 45 percent.

Treasury and Finance Minister Mehmet Şimşek on Feb. 16 said, "We will not do anything out of the ordinary while reducing inflation. Conventional monetary policies will be applied and monetary tightening policies will work.”

Şimşek noted that inflation would fall significantly in the second half of 2024 and price stability would be achieved by 2026.

Turkish Central Bank raises interest rate to 45 percent, halting monetary tightening cycleEconomy

Turkish Central Bank raises interest rate to 45 percent, halting monetary tightening cycleEconomy Turkish Central Bank forecasts 36 pct inflation rate for 2024Economy

Turkish Central Bank forecasts 36 pct inflation rate for 2024Economy Turkey’s official annual inflation hits 64.8 pct in JanuaryEconomy

Turkey’s official annual inflation hits 64.8 pct in JanuaryEconomy