Nothing new in IMF’s Turkey report criticizing lack of transparency

The International Monetary Fund (IMF) Board of Directors concluded its Article 4 consultation with Turkey and released a report on June 11. The IMF noted that Turkey has experienced a strong recovery in growth, but that buffers have been exhausted. Turkey was left with high inflation, low reserves, high external financing needs, and dollarization.

K. Murat Yıldız / Duvar English

The International Monetary Fund (IMF) Board of Directors concluded its Article 4 consultation with Turkey and released a report on June 11. The IMF noted that Turkey has experienced a strong recovery in growth, but that buffers have been exhausted. Turkey was left with high inflation, low reserves, high external financing needs, and dollarization.

Following economic consultations, the IMF pointed out that the country has become increasingly reliant on foreign resources, posing increased risks. The last IMF report on Turkey was released in December 2019.

It is well known that President Recep Tayyip Erdoğan is a critic of the IMF and credit rating agencies. He dislikes such reports and assessments regarding Turkey's economy. Yet, foreign financial institutions and investors make decisions about Turkey based on these reports and evaluations, especially during a time when there is growing distrust in official data and concerns regarding the destruction of institutional independence, particularly for the Central Bank of Turkey which was addressed in the latest IMF report.

The report includes several forecasts for unemployment, growth rates, and current account deficit.

No single-digit inflation in near future

According to the IMF, unemployment in Turkey is expected to reach 12.5 percent in 2021 and 11 percent in 2022. It is worth noting, however, that TÜİK's first-quarter inflation rate is 13.4 percent. In any case, a single-digit unemployment rate does not appear to be attainable anytime soon.

Inflation is expected to remain high, and reserves are expected to decline further, according to the report, predicting numbers far from the government's 2023 inflation target of 5 percent.

The report predicts that growth will be 5.75 percent in 2021 and 3.3 percent in 2022 and beyond. Previous IMF growth forecasts for 2021 and beyond were 6.04 percent and 3.5 percent, respectively.

The IMF stated that the central bank's gross reserve, which was 93.7 billion dollars as of June 4, 2021, is well below the recommended adequacy range, and that the net reserve was negative 47.5 billion dollars, with foreign exchange borrowed from banks with SWAPs excluded. The decline is expected to continue in the future.

Vicious cycle

Furthermore, the report noted that the Turkish economy is becoming increasingly reliant on demand generated by loan growth based on external resources and that using debt to finance the external deficit creates a vicious cycle that necessitates even more foreign financing as public banks take the lead in rapid credit expansion, inflation spirals out of control, and the dollarization trend accelerates.

Other than this vicious cycle, rapid credit growth achieved under public bank leadership, monetary policies and high inflation were cited as factors reducing economic trust and encouraging dollarization.

“Only once in the last 19 years has Turkey had a current account surplus. Only once did our income exceeded our expenses. Money borrowed from abroad was used to pay off the remaining 18-year bill. Our need to find foreign money has grown stronger, more difficult, and expensive as a result of this situation,” economy columnist Murat Muratoğlu pointed out.

No trust in lira

As noted in the IMF report, dollarization and the lack of trust in the lira remains a major problem. “People are not just trying to protect themselves by buying foreign currency. Stocks, cryptocurrencies, land, residences, gold, silver, diamonds, even second-hand cars… They look at everything except the lira as an investment,” Muratoğlu told Duvar English.

The report not only listed drawbacks, but also highlighted positives, such as the government's focus on growth during the pandemic, but it pointed out that the direct contribution of public funds to the policies to combat the pandemic has been limited as Turkey ranks sixth from the bottom among 26 "emerging market economies" in terms of budget transfers to national income, at 1.9 percent according to the IMF.

By depleting its reserves, the country tried to avoid a rise in foreign exchange prices. The reserves' quality has also deteriorated, with non-convertible money and gold accounting for 60 percent of the total according to the report.

The report also points to the negative impact of the firing of Central Bank Governor Naci Ağbal in March 2021, which many took as a sign of Turkey returning to its unorthodox policies and President Erdoğan's interference in monetary policy and his insistence that lower interest rates combat inflation.

The Economic Reform Program, which was announced in March 2021, has been chastised for creating a "Financial Stability Committee" that has marginalized the central bank and failed to diagnose economic problems.

Based on these findings, the IMF called on Turkey to limit state bank credit expansion and ensure effective oversight of banks' external liabilities; strengthen the CBRT’s autonomy, increase reserves, and implement structural reforms aimed at increasing labor market flexibility. Moreover, if inflation expectations deteriorate, the IMF recommended additional tightening.

The IMF board of directors also emphasized the existence of serious risks in the banking sector and advised the government that, as the pandemic's impact and prevalence fades, supervisory flexibility and loan deferral practices provided to banks should be gradually phased out.

Lack of transparency and audit

Moreover, pointing at the controversial Public Private Partnership (PPP) projects the IMF said they should “be tightened, and information should be made transparent to the public” adding that extra-budgetary funds should be made transparent and auditable as well. The Turkish Wealth Fund's investments and borrowings headed by President Erdoğan “should be included in the budget and subject to audit by the Court of Accounts.”

The government’s practice of channeling money into infrastructure projects and big businesses from the unemployment insurance fund has also come to the attention of the IMF as it called on the government not to misuse those funds or deplete them.

“The IMF did not say anything new to be honest, it is stating the obvious. The problems of the Turkish economy and the solutions to them are clear” economy columnist Taylan Büyükşahin told Duvar English. “The issue here is that, as always, the government will ignore the IMF's or anyone else's advice and warnings,” he concluded.

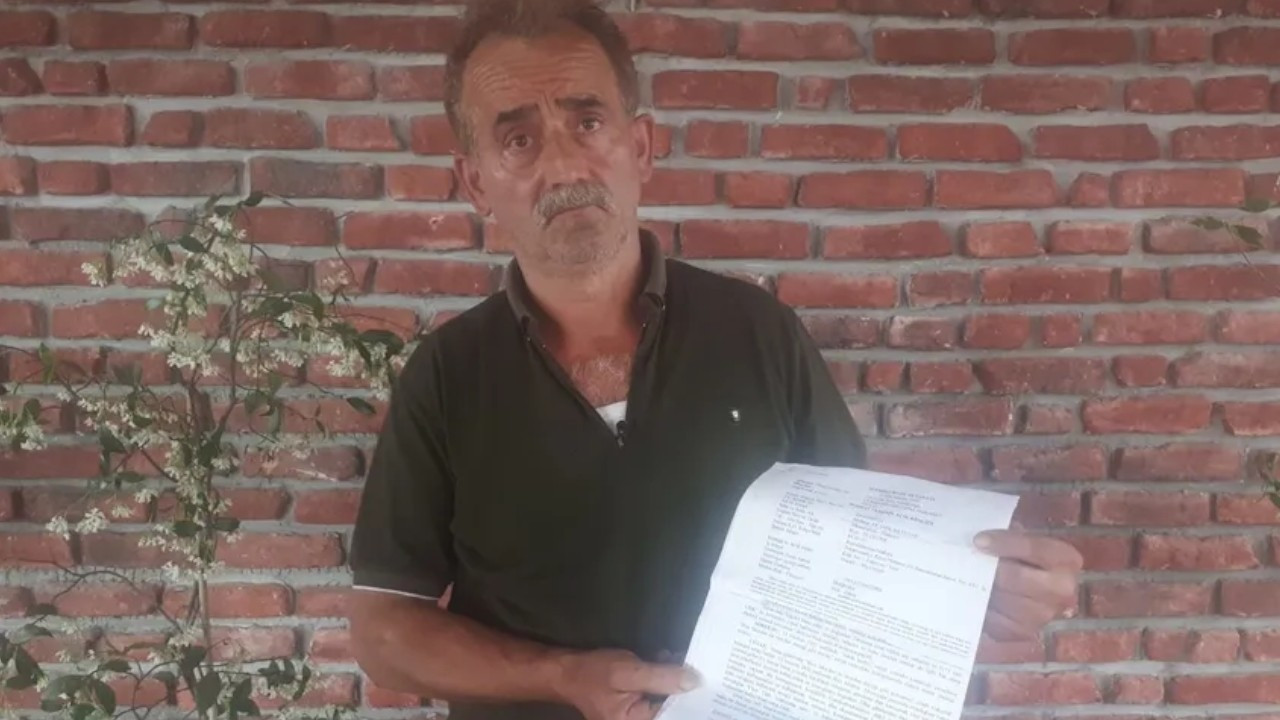

Turkish man from Erdoğan's hometown detained for criticizing ailing economyHuman Rights

Turkish man from Erdoğan's hometown detained for criticizing ailing economyHuman Rights Unemployment in Turkey worse than gov’t claims, especially for women and youthEconomy

Unemployment in Turkey worse than gov’t claims, especially for women and youthEconomy Lira weakens after Erdoğan says stance on S-400s remains unchangedEconomy

Lira weakens after Erdoğan says stance on S-400s remains unchangedEconomy