Turkey now leading Europe in coal-fired electricity production

Turkey has surpassed Germany to become Europe's largest producer of coal-fired electricity in the first four months of 2024, according to data from the energy think tank Ember.

Reuters

Turkey overtook Germany to become Europe's largest producer of coal-fired electricity over the first four months of 2024, data from energy think tank Ember shows.

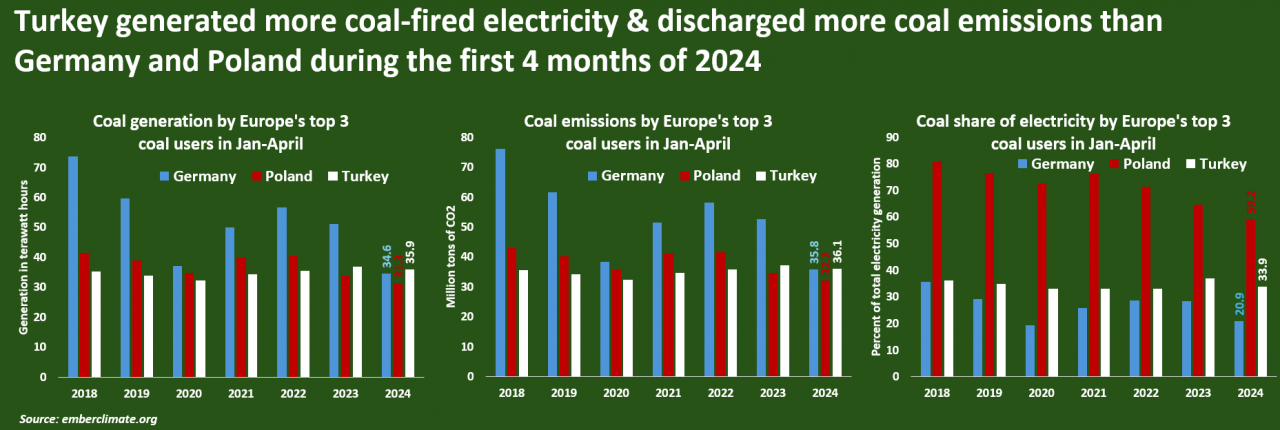

Turkey's 36 terawatt hours (TWh) of coal-fired electricity output through April exceeded the 34.6 TWh produced by Germany's utilities over the same period, as well as the 31.3 TWh of coal-fired electricity in Europe's third-largest coal user, Poland.

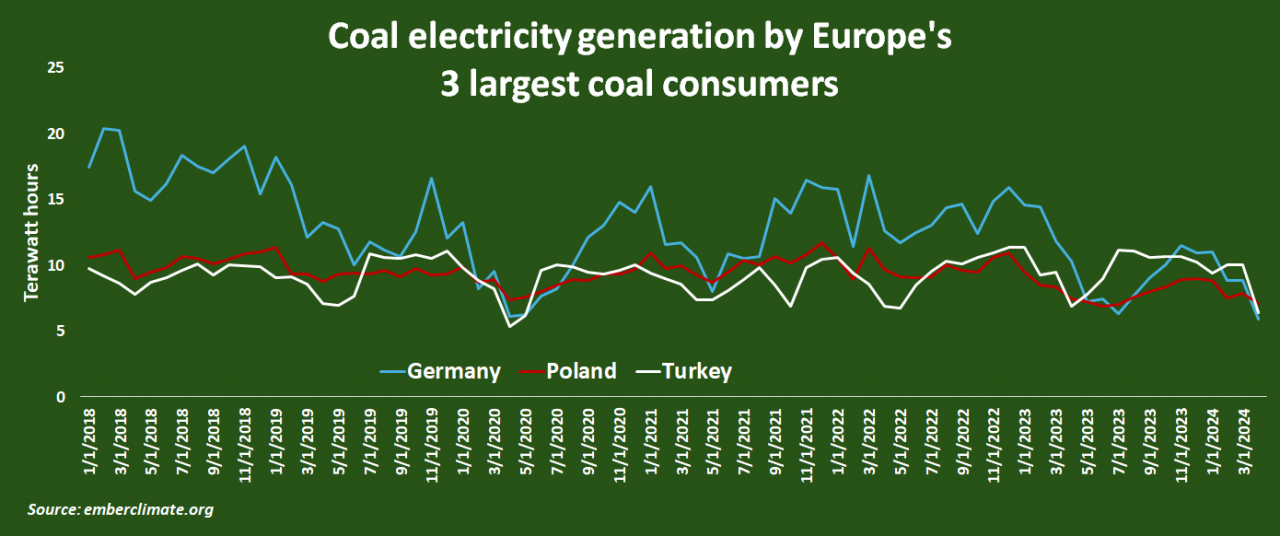

The main driver of Turkey's ascendance in regional coal rankings was a steep drop in Germany's coal use during the January-April window, which was 32% lower than the same period in 2023 and the lowest for that time frame on record.

Turkey's coal-fired output total was roughly 3% less than during the same months in 2023, but was the second-highest tally for that period on record and marked a roughly 6% climb from the first four months of 2019.

In contrast, German and Polish coal-fired generation through April was down 42% and 19.4%, respectively, from the same months in 2019, indicating a sustained drive within major northern European economies to trim coal use in power generation over the past five years.

If utilities in Germany and Poland make further cuts to coal use this year, 2024 may mark a turning point in Europe's energy transition efforts by shifting emissions focus away from established industrial economies to regional emerging markets where coal remains a key power fuel.

CLEAN DIVERGENCE

Rapid recent expansions to clean energy generation capacity in Germany, Poland and other wealthy economies in northern and western Europe have been instrumental to coal's reduced status in those power systems.

Between 2022 and 2023, clean generation capacity expanded by 9% in Germany, 21.4% in Poland, 21% in the Netherlands, 9.6% in Italy and by 8% in Spain, according to Ember, thanks in part to large government subsidies designed to aid energy transition efforts away from fossil fuels.

In contrast, clean generation capacity in Turkey expanded by 4.5% from 2022 to 2023, where a widening government budget deficit has constrained subsidy spending.

Clean generation capacity growth in 2023 was also limited in Czechia (1.1%), Romania (1.4%) and Serbia (3.6%), highlighting a widening clean power development gap between wealthy and developing nations in the European region.

COAL RELIANCE

In addition to sluggish clean energy generation capacity growth, Turkey, Czechia and Serbia, along with Bulgaria, are home to some of Europe's most coal-reliant power systems.

Over the first four months of 2024, coal accounted for an average of 34% of total electricity generation in Turkey, 35% in Czechia, around 30% in Bulgaria, and 59% in Serbia.

Those averages compare to 21% in Germany and around 13% for Europe as a whole.

Turkey's coal reliance is strengthened by the country's pace of economic growth, which is one of the fastest in Europe.

Turkey's real gross domestic product expanded by an average of 4.5% a year from 2019 through 2024, according to data and estimates from the International Monetary Fund.

That growth pace is 3.5 times faster that the European average, and around 1.6 times faster than the global average, and means that the country's total energy requirements have expanded by a similar degree.

Turkey's utilities have struggled to keep up with such a strong expansion in energy demand, and have been forced to maintain a heavy reliance on coal plants to generate a major share of total electricity.

Recent shortfalls in local output from hydropower dams due to drought have also heightened the need for coal power.

To meet sustained high levels of coal use, Turkey has had to boost coal imports, which in 2023 totaled 24.2 million metric tons, according to ship-tracking firm Kpler.

That total was the country's second-highest on record, made Turkey the ninth-largest importer globally, and by far the largest importer in Europe.

EMISSIONS TOLL

As a result of sustained high coal-fired generation, total emissions of carbon dioxide (CO2) from Turkey's coal-fired plants were just over 36 million metric tons during the January to April window, Ember data shows.

That total surpassed the 35.8 million tons emitted by German plants and 32.2 million tons by Poland's coal plants.

Along with the steady emissions from the nearby coal plants of Bulgaria and Serbia, Turkey's roughly 10 million tons of coal emissions a month means that Southern Europe is now a major source of coal emissions on the continent.

And if that high emissions pace is sustained while power systems elsewhere in Europe continue to cut back on coal use, Turkey could quickly emerge as a key contrarian in regional coal cutting efforts which may impede the entire region's energy transition efforts.

Yet another mine collapses in Turkey, kills one minerDomestic

Yet another mine collapses in Turkey, kills one minerDomestic Report shows coal pollution behind 200,000 premature deaths in TurkeyEnvironment

Report shows coal pollution behind 200,000 premature deaths in TurkeyEnvironment Coal power plant to pollute 24 provinces across Turkey, make millions ill over decadesEnvironment

Coal power plant to pollute 24 provinces across Turkey, make millions ill over decadesEnvironment