Turkish lira in freefall after Erdoğan stokes firesale

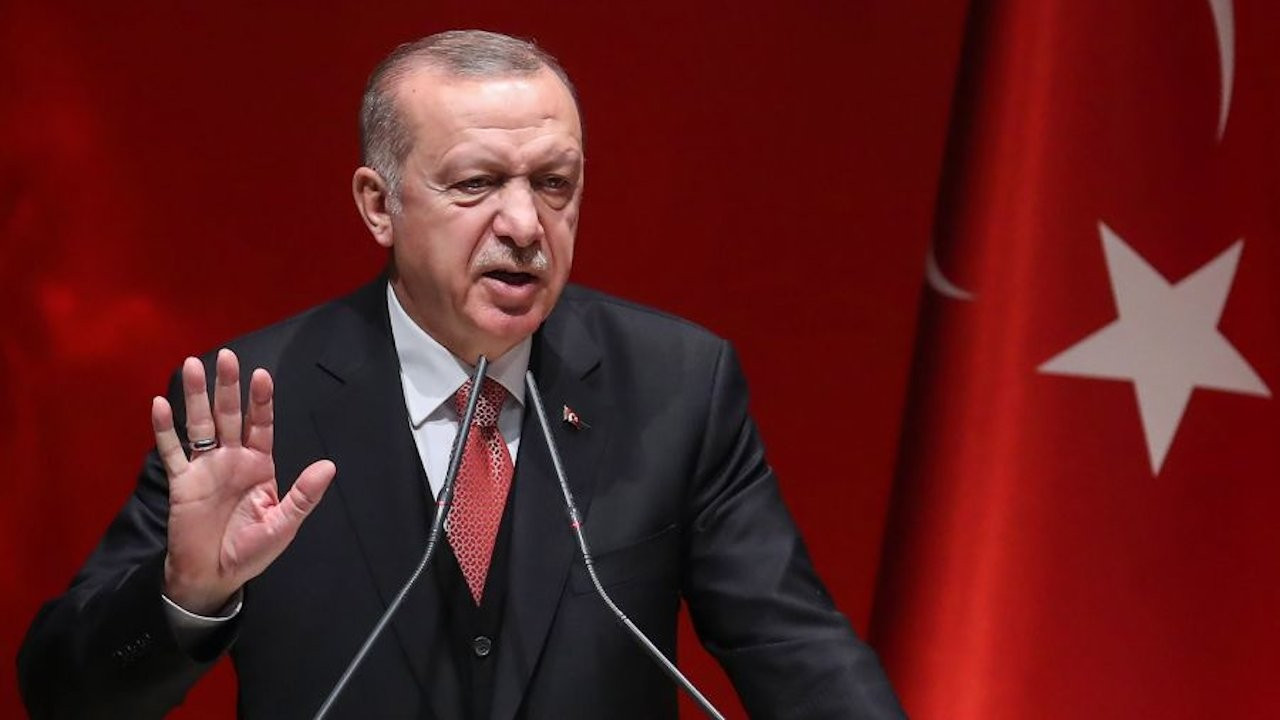

Turkey's lira nose-dived nearly 9% on Nov. 23 after President Recep Tayyip Erdoğan defended recent sharp rate cuts, and vowed to win his "economic war of independence" despite widespread criticism and pleas to reverse course.

Duvar English - Reuters

The Turkish lira suffered its worst day since a currency crisis three years ago after President Recep Tayyip Erdoğan praised a recent interest rate cut and declared that his country was fighting an “economic war of independence."

The currency, which is down 42 percent against the dollar this year, plunged as much as 11 percent on Nov. 23 — the biggest drop since August 2018 — and broke through the symbolic threshold of 13 to the dollar after Erdoğan used a combative speech to expound his vision for the country’s economy.

Erdoğan has applied pressure on the central bank to pivot to an aggressive easing cycle that aims, he says, to boost exports, investment and jobs - even as inflation soars to near 20% and the currency depreciation accelerates, eating deeply into Turks' earnings.

Former central bank deputy governor Semih Tümen, who was dismissed by Erdoğan last month, called for an immediate return to policies that protect the lira's value.

"This irrational experiment which has no chance of success must be abandoned immediately and we must return to quality policies which protect the Turkish lira's value and the prosperity of the Turkish people," he said on Twitter.

The slide was the lira's biggest fall since the previous central bank chief was dismissed in March and its 11 days of losses were its worst run since November 1999. The lira has been by far the worst performer in emerging markets this year due mostly to what analysts call reckless and premature monetary easing.

Against the euro, the currency weakened to a fresh record low of 13.8815 on Nov. 23.

The lira tumble comes after a slide in support for Erdoğan's ruling Justice and Development Party (AKP) in opinion polls and opposition calls for early elections before those scheduled for 2023. It has also intensified Turks' concerns about the sharply rising cost of living.

"Prices are rising too fast. I don't want to buy certain products because they've got too expensive," said Kaan Acar, 28, a hotel executive in southern Turkey’s Kalkan resort, adding he was thinking of canceling a trip abroad due to the rising cost.

"The fault lies with President Erdoğan, the AKP government, and those who for years turned a blind eye and supported them."

Investors appeared to desert the lira as volatility gauges spiked to the highest levels since March, when Erdoğan abruptly sacked the hawkish former central bank chief and installed a new governor, like the president a critic of high rates.

The 10-year benchmark bond yield rose above 21% for the first time since the start of 2019. Turkey's sovereign dollar bonds fell more than 1 cent in early trading, Tradeweb data showed.

As the lira plunged, the main share index rose 1% due to suddenly cheap valuations. However bank stocks dropped, with the banking index down 1.3%.

Emergency hike

The central bank cut its policy rate on Nov. 18 by 100 basis points to 15%, well-below inflation of nearly 20%, and signalled further easing.

It has slashed rates by a total of 400 points since September in what analysts have called a dangerous policy mistake given deeply negative real yields, and given virtually all other central banks have begun, or preparing to, tighten.

Analysts said emergency rate hikes would be needed soon, while speculation about a cabinet overhaul involving the finance minister, Lütfi Elvan, have also weighed.

Erdoğan defended the policy in a news conference late on Nov. 22 and said tighter monetary policy would not lower inflation.

"I reject policies that will contract our country, weaken it, condemn our people to unemployment, hunger and poverty," Erdoğan said after a cabinet meeting, prompting a late-day slide in the lira.

Societe Generale said on Nov. 22 the central bank would need to deliver an "emergency" hike as soon as next month and lift the policy rate to about 19% by the end of the first quarter of 2022.

"Risks are skewed for more depreciation," said Guillaume Tresca, senior EM strategist at Generali Insurance Asset Management, adding he expected Turkey's turmoil to have a limited impact on other emerging market countries and assets.

"We do not see value in Turkish assets yet. The main difference from previous market stress episodes is the limited push-back from authorities. There is a clear will for a weaker FX," he added in a note.

CHP slams AKP's comparison of Turkey's economy to JapanEconomy

CHP slams AKP's comparison of Turkey's economy to JapanEconomy Turkish gov't dismisses opposition leaders' call for urgent early elections amid economic crisisPolitics

Turkish gov't dismisses opposition leaders' call for urgent early elections amid economic crisisPolitics 'Preparation for Power': Opposition prepares plan for Turkey’s flailing economyEconomy

'Preparation for Power': Opposition prepares plan for Turkey’s flailing economyEconomy AKP MP attempts to defend Turkish economy by comparing it to JapanEconomy

AKP MP attempts to defend Turkish economy by comparing it to JapanEconomy Stop!: Turkish main opposition leader to Erdoğan after central bank rate cutEconomy

Stop!: Turkish main opposition leader to Erdoğan after central bank rate cutEconomy