Fire department adding fuel to the flames

The Central Bank of the Republic of Turkey (CBRT) continues to be a part of the economic policy conducted by the government. The ground of the economic crisis was laid with the fire of a political crisis. It moved to a new level with the pandemic. Now, there is no possibility left that the Central Bank helps bounce back or curbs the situation.

At a problematic time when it is obvious that the balance of payments will worsen due to the pandemic; the Central Bank of the Republic of Turkey (CBRT) continues to be a part of the economic policy conducted by the government. This policy is one where the Turkish Lira is poured into the markets, where there is a giant loan boost in an economy which is indebted in foreign currency. It is an environment in which conditions are created where banks are forced to lend; moreover, where these loans are made cheaper. In such circumstances, this Central Bank will be trapped under the severe value loss of its own currency as well as the giant loss of reserves.

Turkey's central bank keeps rate on hold that sends lira to new low

Turkey's central bank keeps rate on hold that sends lira to new lowTheCBRT continues to act in pretense in the follow up, which causes thatit has no credibility left.

Inthe past, the CBRT was known for its role as “the fire servicewhich was always late to arrive at the scene of the fire.” In thepast couple of years our CB has adopted the role, “the firedepartment which adds fuel to the flames.” This is what ishappening in Turkey recently. This is the outcome a country’seconomy faces, when its central bank operates upon politicaldirectives.

Atits October meeting, the Central Bank did not raise interest rates,contrary to the expectations of market analysts and economists.

Theexpectation was that since the day before the Monetary Policy Board(PPK) meeting on Thursday, October 22, the CB had adjusted theaverage interest rate of the money it supplied to the market to 12.5percent, it was thought that the 10.25 policy rate would be raised tolevel of 12 percent or 12.50 percent during the PPK meeting.

The Central Bank did not raise interest rates. In the text summarizing the meeting, there was a lot of “beating around the bush.”

Nobodyknows the “reaction function” of the Central Bank; thus, nobodycan predict it. Even at a time when they think they can foresee, theyfail.

Onthe downside, the Central Bank has set the Late Liquidity Window(LON) interest rate at 14.75 percent to create room for maneuver fora supposedly “tightening.”

The meaning of this is that the CB can now lend one-weak repo at 10.25 percent; can lend money overnight at 11.75 percent or can hold auctions for banks so that they will be able to determine the rates, for instance lend money at 13.5 percent monthly. So, when will it lend money at LON at 14.75 percent? It will do this: It will not provide money to any of the banks or supply only half of their needs and wait until the evening so that banks will have to deal with deficits. Then it will ask them, “Were you not able to close?” and it will offer them, “Here is money for you at 14.75 percent.” The Late Liquidity Window is not a tool for monetary policy. Raising the interest rate of LON is not tightening either. LON is the “whistle of the pressure cooker.” When a bank is at that stage, it is considered that that bank is giving the alarm. When a bank is not able to adjust its liquidity, then it will opt for LON. All around the world, this situation is considered as “not able to pay its debts.” Besides, no Central Bank would force banks to LON just because it was “tightening.”

Turkish Central Bank's net international reserves shrink dramatically as lira hits new low

Turkish Central Bank's net international reserves shrink dramatically as lira hits new low‘Avery accurate step’

Theproblem of freedom of expression in Turkey is very well seen in theanalyses of economic policies. For instance, while analyzing a wrongand inaccurate decision, there are only a handful of reports thatopenly say these decisions were wrong and erroneous. However, when astep is taken back from these decisions, then there would be dozensof reports and comments on how correct it has been to return to theprevious situation.

Thiswas how the comments looked regarding the policy the CB adopted.

Priorto the Central Bank’s September meeting, while the policy rate was8.25 percent, the average funding rate was adjusted to 10.6 percentlevel with the tightening of liquidity. When the policy rate wasincreased to 10.25 percent in the Monetary Policy Committee, we hearda lot of “Yes, this was a very accurate decision.”

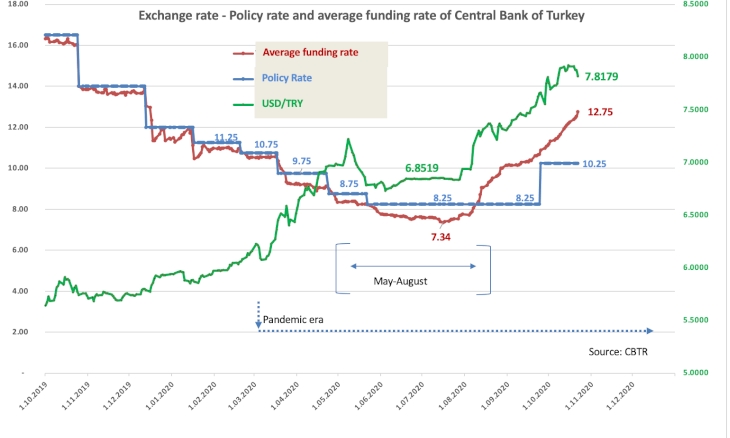

Infact, while the official policy rate was 8.25 percent in July, thebank had lowered the average funding rate to 7.34 percent, in otherwords, roughly 1 point below, and nobody was heard asking, “Howcome there can be such a monetary policy?”

In October, when the bank did not raise the rates, we did not hear any comments saying, “This has been an extremely wrong decision.”

What has happened?

Withits “pitch and toss” policy, the bank did not even attempt tocorrect its recently made past mistakes.

InJuly, when liquidity was provided at 7.34percent, the end of year inflation expectation was 10.22 percent, andthe same figure for the next 12 months was 9.33 percent. The bank’spolicy rate was at 8.25 percent but on the day of July 16, it waslending money at 7.34 percent.

Thisshocking situation, alongside providing liquidity supply at a ratewell under inflation and expectations, was accompanied by a giantcredit boom.

Also,on the week of July 10, the Turkish Lira loan increase for the lastthree months was a record of 43 percent, reaching a peak of 324billion liras.

Thetragic aspect of the issue was that with the “active ratio”invented by the banking authority, banks were driven toward riskyloans. To be able to meet the ratio requirements, the banks were togive credits to whoever comes or opt for ways such as depositreduction or increase in stocks of treasury bonds. Banks preferred toreduce deposits as one of the alternatives. This pushed the interestrates on deposits in the market some 2 to 3 points below the CentralBank’s policy rate. Thus, there was a negative real interest.

Again,during the same time, foreign currency reserves of the country werebeing wasted to keep the dollar exchange rate at 6.85 in somewhat“back door” methods.

Ifyou show this scheme to a freshman student in economics, she or hewould tell you without hesitation that this was nonsense andunsustainable.

As a matter of fact, this was exactly what it turned out to be. The level of 6.85 dollars exchange rate - which has no real basis - was unable to be maintained because all the foreign currency reserves had been spent.

As of beginning of August, the forex rate started its climb and it reached a level very close to 8 in October. This is because public banks again are selling to hold the rate at 7.95.

Atthe end of July, the Central Bank issued its Inflation Report in thisatmosphere. Ignoring that the consequences of such a policy wouldoccur soon, the bank shared its forecast that inflation rate at theend of 2020 would be within the band 6.9 and 10.9 percent (midpoint8.9 percent), while at the end of 2021 it would be between 3.9 and8.5 percent (midpoint 6.2 percent).

TheCentral Bank was ignoring the credit boom, negative real interestrates, the “active ratio” suffocating the banks and the pressureon the forex rate; and it estimated the end of year inflation maximumat 10.9 percent. Meanwhile, the bank was lending at an average of 7.5percent. Now, in a technical note issued regarding Septemberinflation, the bank estimates that the trend of core inflation isbetween the band 13 and 14 percent.

Prior to the October meeting, the level the average funding interest rate reached was 12.5 percent. In other words, it was behind its self-calculated inflation dynamic.

CB before the decision

TheCentral Bank had an effective funding of 10.6 percent prior to theSeptember meeting. It decided on a 10.25 percent policy rate at themeeting. Even the next day after the meeting, the repo lending of thebank was at 10.25 percent. When it recognized it was not able to curbthe forex rate, it gradually tightened liquidity conditions, reaching12.57 percent on October 21.

For this reason, it was expected that the interest rate decision of the meeting on Thursday, would be 12.25 percent, in accordance with the median of expectations in the Foreks survey. In other words, it was expected that the actual market prices would be made official. If the bank had done this, it would still have been behind its own self, but now it has totally lost control.

Why was CB not able to raise it?

Itwas because there is a difference between making official the dailysmall dose of raises, and making a once for all interest rate hikeofficially at the beginning. They are different from the point of“political acceptability.”

Sincemid-July, the average funding rate has been increased by almost 5points. To make this official would be the same as crushing thePresidential Complex of Beştepe’s “interest rate-inflation”policy. It was not approved.

As a result, if the starting point is taken as the end of July when the defense of the dollar rate at 6.85 went bankrupt, the increase in the exchange rate as of October 20 has been 15 percent.

Considering that the Intermediate goods price increase between July and September - only in two months - has been 8 percent, it will not be too difficult to estimate the potential increases from producer prices to retail prices.

TheCentral Bank failed to adopt a proactive position to curb inflation.It embarrassed even those who proclaimed in September that it was acorrect step.

TheCentral Bank has put another log in the fire of the balance ofpayments Turkey is suffering from. Also, in the devaluation/inflationcycle.

Theground of the economic crisis was laid with the fire of a politicalcrisis. It moved to a new level with the pandemic. Now, there is nopossibility left that the Central Bank helps bounce back or curbs thesituation.

Moreover, it is not even possible for the Central Bank to take measures by increasing the interest rates to 25 percent. The basic reason for residents to have a tendency for gold and foreign currency is the crisis in the political arena in Turkey and a huge distrust.

The depreciation of the Turkish lira will not stop unless politics in Turkey normalizes.

Themoney of a country which has institutions and rules, which respectsrule of law, which is accountable, which safeguards democratic valuesis first and foremost trusted by its own citizens. And thesecitizens, ideally, would hold on to and protect their own currency.